Supplemental Life Insurance Vs Ad&d

Supplemental Life Insurance would pay for death by any reason. If you feel that your employers life insurance amount is not sufficient for your needs purchase the supplement Life policy.

Supplemental life insurance is when a rider is purchased to increase the value of the policy without taking out a new life insurance policy altogether.

Supplemental life insurance vs ad&d. Supplemental life insurance is not required but highly desirable and extremely helpful in many situations. While an ADD policy will only cover death if caused by an accident term life insurance will cover almost all causes of death. That is you can purchase ADD insurance or burial insurance on the private market.

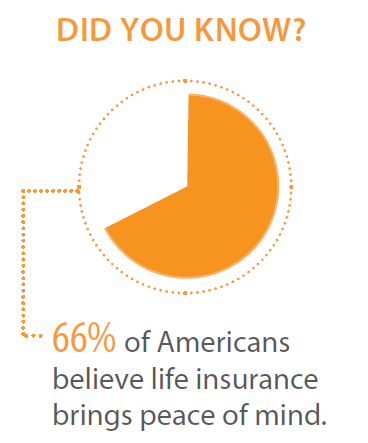

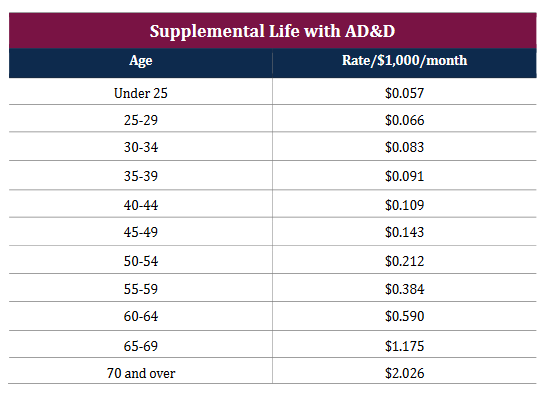

Ad Indulge In The Latest Fashions Find Your Next Favourite At Victorias Secret Online Now. For people with health issues supplemental life insurance may be more affordable than individual life insurance. The policy lasts for a specified term 10 15 20 or even 30 years and has a very affordable monthly premium.

Term life insurance is simple. A life insurance rider is an addendum to a policy that provides additional coverage. However these policies often have some exclusions.

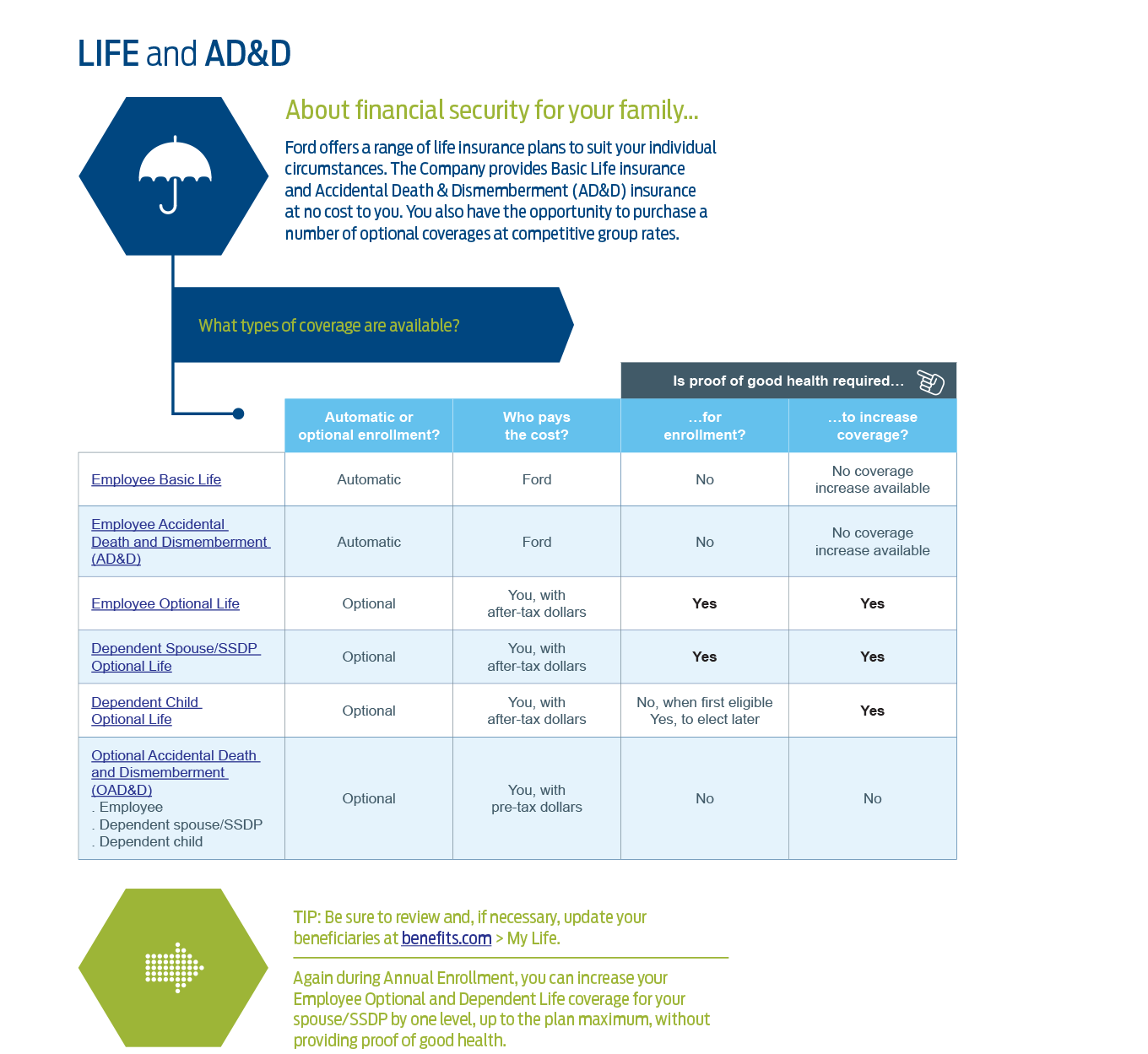

Supplemental life insurance vs ADD Some employers offer supplemental benefits which can include life insurance. Treat Yourself Feel Sexy And Chic For The Beach With Victorias Secret Today. To 50 of the original amount at age 75.

Treat Yourself Feel Sexy And Chic For The Beach With Victorias Secret Today. If the policy pays itll be a pleasant bonus for your beneficiaries but you shouldnt count on it. Spouse Supplemental Life and ADD coverage reduces the same as the employees.

These policies may not require a medical exam and are given group rates based on age. Ad Indulge In The Latest Fashions Find Your Next Favourite At Victorias Secret Online Now. One major difference between basic and supplemental life insurance is that the former is a complete policy while the latter is only an upgrade.

Supplemental insurance is not usually available on a term life policy because that type of coverage is already constrained within certain defined limits and conditions but is more often taken out to supplement a whole or variable life insurance. An ADD rider pays out an extra amount if death is due to an accident but if the death is from natural causes the policy simply pays out the base amount. What is the difference between Life and ADD Insurance.

This means basic life insurance is somewhat necessary but supplemental life insurance is a choice. Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations such as ADD or burial insurance. Here are the top 10 comparisons for Supplemental Life Insurance Vs Add based on our research.

Far more deaths occur as the result of illness than accident. How much can I purchase. Do I still pay my Life Insurance premiums if I become disabled.

If your life or group policy includes ADD dont include the benefit amount in your planning. ADD is Insurance that pays an additional benefit if you are seriously injured or die due to a covered accident. Employee Basic Life and AD.

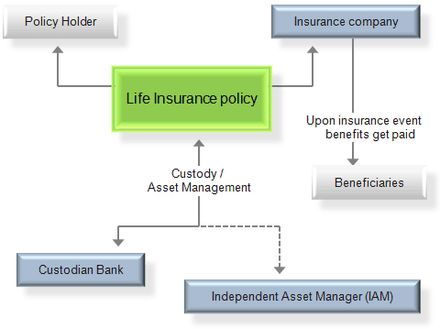

Therefore if your goal is to provide your family with a financial safety net if you die life insurance is the right purchase. In fact you may be able to buy these policies as a rider on. Ask an expert if the life insurance company youve chosen offers an ADD rider.

All coverage terminates upon employees retirement. ADD could be a good supplemental policy if you already own life. Basic and Supplemental Life Insurance pays a benefit if you die for any reason except those excluded in the certificate of insurance.

In comparison ADD protection is only of marginal value. When youre deciding on your coverage life insurance is fundamental for most young couples. Supplement ADD Insurance would only pay for death or dismemberment due to accident.

Supplemental ADD insurance sometimes offered alone or as a supplement to other life insurance programs provides additional money to your beneficiaries in the event you die or become dismembered in an accident.

The Basics Of Life Insurance Texas Bar Private Insurance Exchange Texas Bar Private Insurance Exchange

Types Of Life Insurance The Insurance Bulletin

What Is Voluntary Life Insurance Vs Basic Life Insurance Free Quotes Quickquote

Life Insurance Plans American Fidelity

Pin On Advisorist Vision Board

Key Questions For Educators To Ask About Life Insurance Nea Member Benefits

Term Life Insurance Financial Resources Coverage Options Fidelity

Life Insurance Operations I Professional Financial Planning

Ppt Group Term Life Insurance Ad D Disability Income Insurance Dental Insurance Powerpoint Presentation Id 4134481

Post a Comment for "Supplemental Life Insurance Vs Ad&d"