Business Insurance Cost Llc

You can also call 855-829-1683 and speak with one of our insurance specialists. Your LLC insurance cost is the total of all the policies your business requires.

6 Best Small Business Insurance Of 2021 Money

This is where having general liability insurance becomes incredibly important.

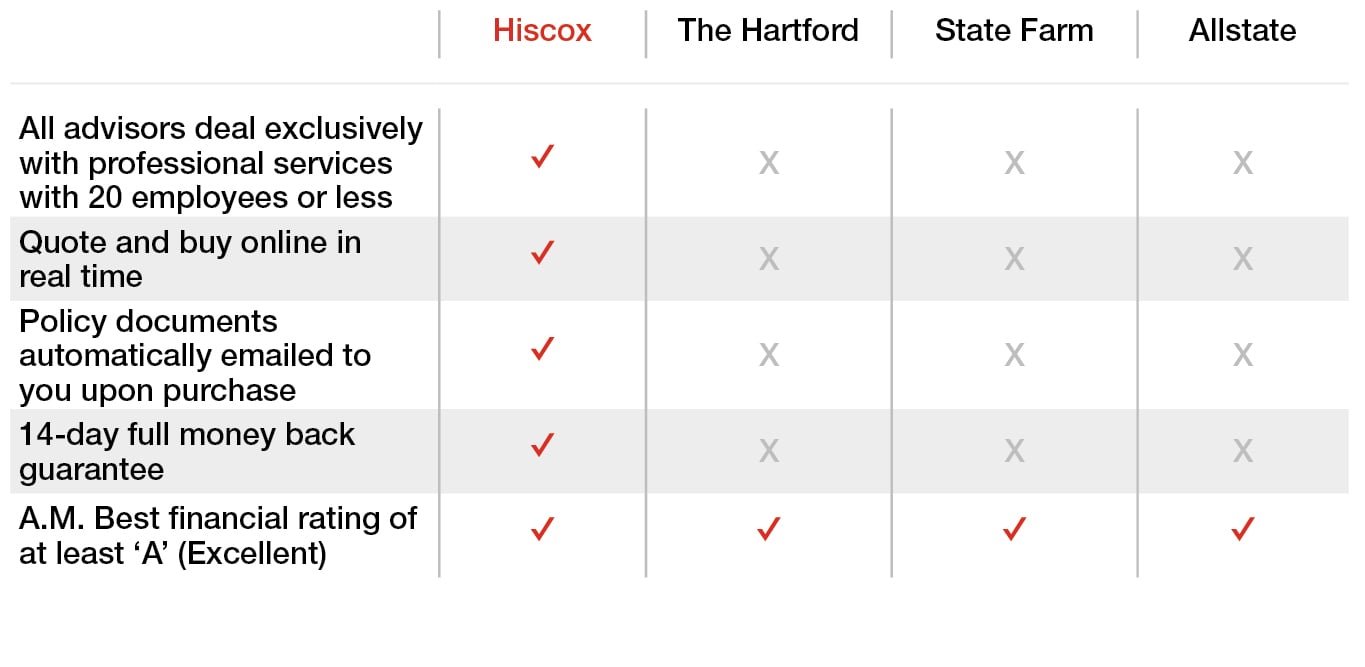

Business insurance cost llc. Harborway Insurance policies are underwritten by Spinnaker Insurance Company and reinsured by Munich Re an A Superior rated reinsurance carrier by AM. We recommend doing some research into the risks faced by your business and getting a business insurance quote from a trusted source. Even if your business is running on a tight budget LLC insurance is one of the best investments you can make.

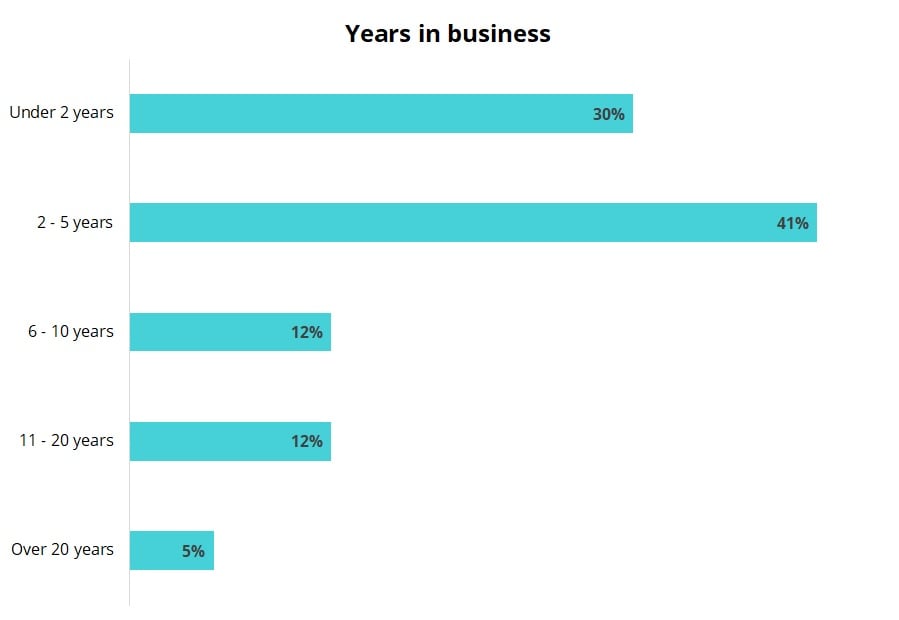

The more risk your company faces the more expensive your LLC business insurance. Your Industry Requires Coverage. So we know every small business is unique.

In addition to workers compensation unemployment tax and disability insurance you should get several other insurance policies to protect your LLC. 500 annually or about 42 per month. Another reason why an LLC would need business insurance is that it is a rule of operations.

Insureon says the average mean cost of their 18000 policies is about 100 a month while the median cost is about 50 per month. Most businesses pay between 350 to 1000 per year for BOPs. In some cases coverage extends to both the LLC and the owners.

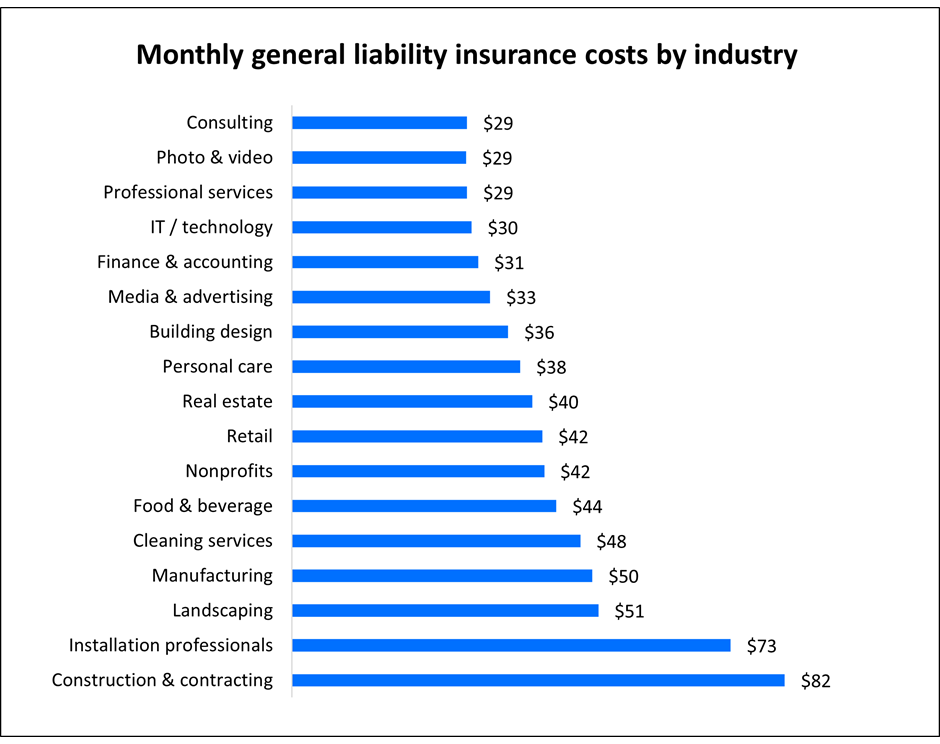

How Much Does LLC Insurance Cost. The Small Business Association says the cost for a small business general liability policy usually ranges from 750 to 2000 annually or approximately 60 to 170 per month. What Is the Average Cost of Small Business Insurance.

The cost of your policy will depend on coverage and a number of other factors like the size nature and location of your business and the materials you use. Harborway Insurance is a trade name of Simply Business Inc which is a licensed insurance producer. Owners of even the smallest businesses.

Below are some answers to commonly asked limited liability company insurance questions. The median cost of a business owners policy which bundles general liability with property insurance at a discount was 53 per month or 636 annually. LLC insurance protects your business from lawsuits with rates as low as 27mo.

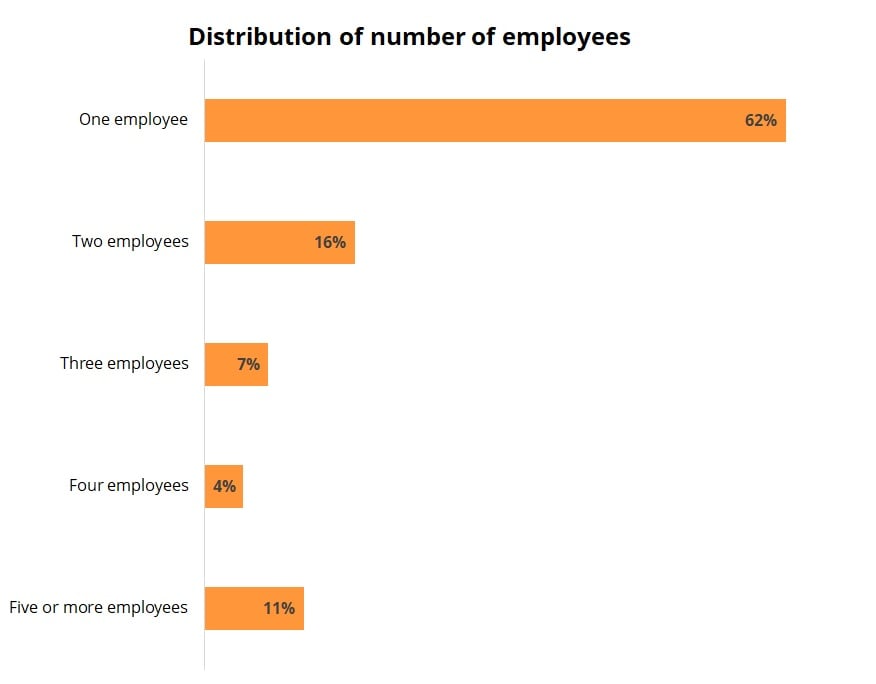

Also known as malpractice insurance or errors and omissions EO insurance professional liability insurance is usually necessary for LLCs or professional limited liability companies PLLCs whose members are. Do I need Business Insurance if Im a Sole Proprietorship. Most insurance companies compute premiums based on your payroll your business location whether you are in a litigation-prone industry your total number of employees your products or services and claims history.

The LLC Insurance cost varies depending on your business and the types of coverage you wish to acquire. The average cost range of an LLCs liability insurance policy generally ranges from about 300 to 1000 per year however different types of businesses will have different needs and incur different risks. How Much Does LLC Insurance Cost.

A small accounting firm with just a few employees might pay between 350 and 1600 for a business owners policy with 2 million in coverage. Having this peace of mind is absolutely worth it. It can protect both the business and owner assets.

What Type Of Insurance Do LLCs Need. The cost of business insurance for an LLC is typically between 700 and 3800 a year but it depends on what types of insurance your business needs. There are several variables that will affect the premiums for your specific business.

In 2020 the average monthly cost of a new 12-month business insurance policy through the Progressive Advantage Business Program ranged from 46 for professional liability to 86 for workers compensation. Get a fast quote and your certificate of insurance now. Our team can help make sure your small business complies with state laws and help you prepare for the unexpected.

It will cover the damages from the lawsuit in addition to any legal costs involved. Business Liability Insurance Costs While there really are no average business liability insurance costs for both small and large businesses we can consider some sample scenarios. Do I Still Need Insurance With An LLC.

However LLC owners in some industries may also need professional liability insurance which usually costs between 800 to 2500 annually as well as other policies like commercial auto or cyber liability insurance. Small business insurance costs vary widely based on industry location and coverage types. The table below shows median and average monthly costs for common business insurance policies.

In general business liability insurance protects your small business in the event of a lawsuit for personal injury andor property damages. Here are the median costs for the most common LLC insurance policies based on our own customer data. A sole proprietor might pay 500 per year for general liability insurance but a small consulting firm is likely to pay over 3000 per year.

To find out how much LLC insurance may cost your business get a quote today.

Business Insurance For Life Coaches

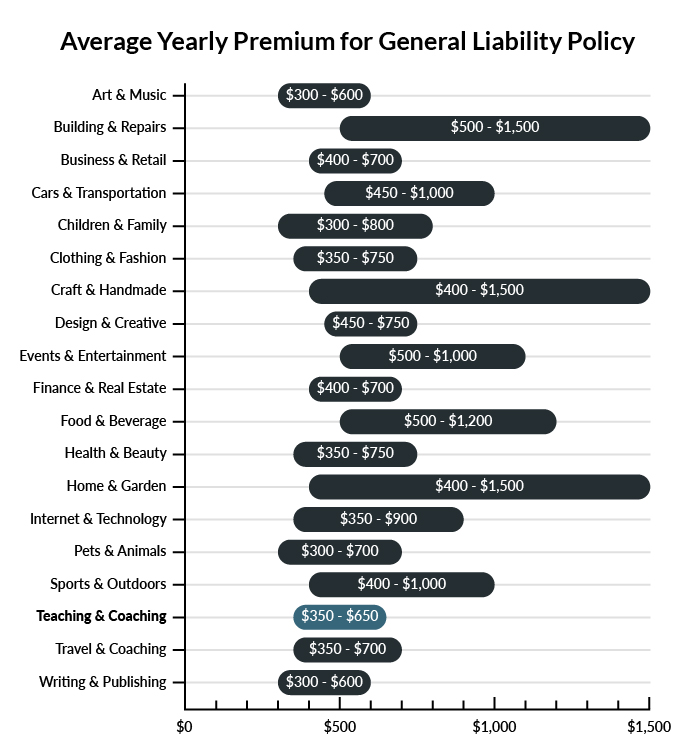

General Liability Insurance Cost Insureon

General Liability Insurance For Small Business Coverwallet

With The Cost Of Health Insurance Health Care Rising More And More This Is An Important Item To Think About W Business Insurance Health Insurance Health Care

General Liability Insurance For Small Business Coverwallet

Business Insurance For Life Coaches

General Liability Insurance Business Liability Insurance

Pin On Commercial Business Insurance

General Liability Insurance Business Liability Insurance

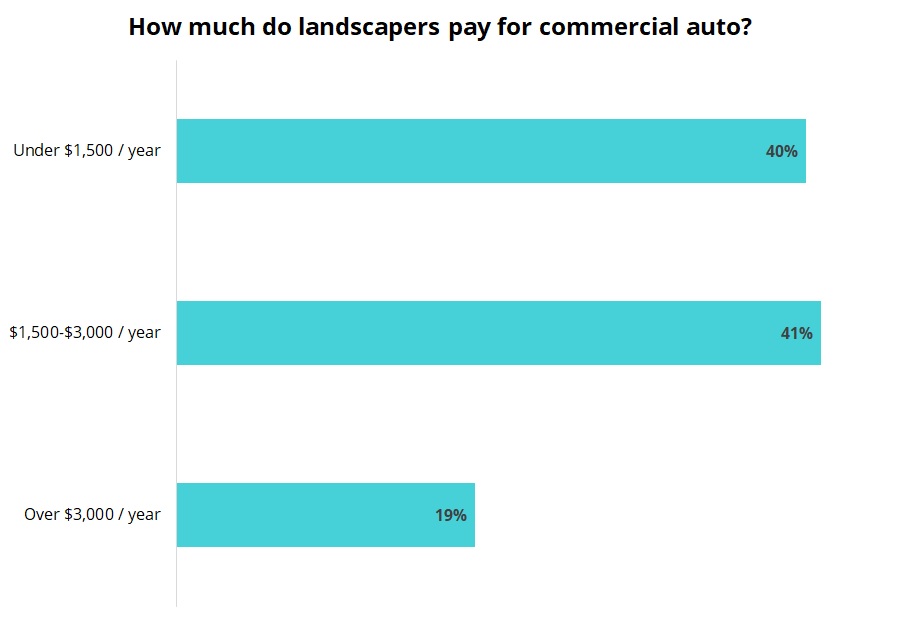

Cost Of Landscaping Business Insurance Insureon

All You Need To Know About Liability Insurance Cost Liability Insurance Cost General Liability Liability Insurance Insurance

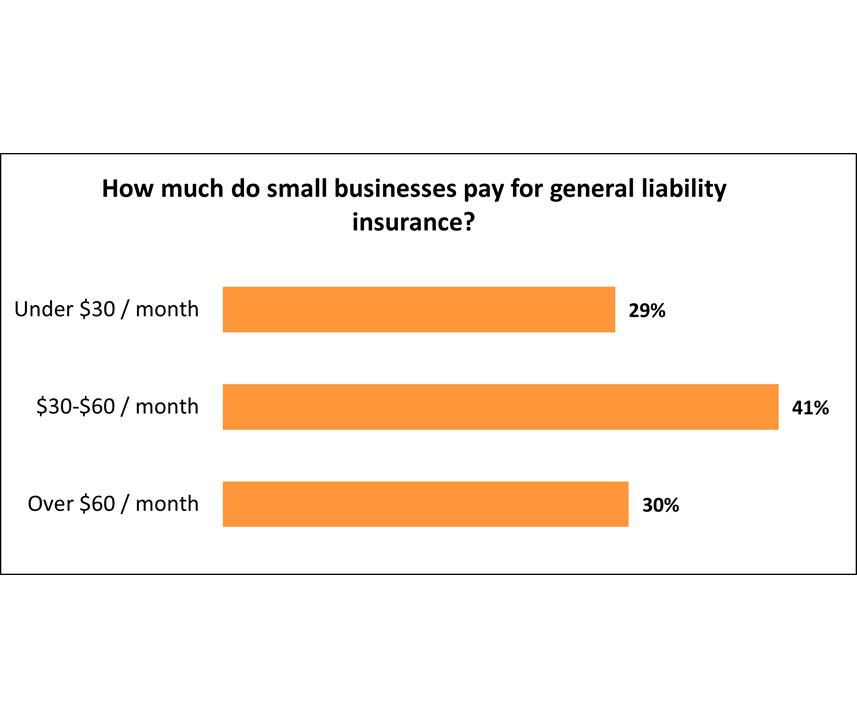

Small Business Insurance Cost Insureon

Atlanta Business Insurance Small Business And Liability Insurance Hiscox

Can You Have Multiple Auto Insurance Policies Di 2021

Post a Comment for "Business Insurance Cost Llc"