Unemployment Insurance California Employer

As a result of the COVID-19 pandemic more than 16 million Americans have filed for. Take the Necessary Steps.

Https Www Kyccla Org Wp Content Uploads 2020 04 Edd E2 80 94 Notice Of 0 Benefit Eng Pdf

This claim is basically a notification to the state the federal government and the previous employer that they are seeking unemployment insurance benefits.

Unemployment insurance california employer. If your small business has employees working in California youll need to pay California unemployment insurance UI tax. Learn how to qualify for unemployment benefits. The new employer SUI tax rate remains at 34 for 2021.

The average claim can increase an employers state tax premium 4000 to 7000 over the course of three years. Starting January 1 2020 workers will be considered employees unless proven otherwise. Generate custom road maps of information so your business can operate safer protect employees and prevent the spread of COVID-19 in the workplace.

447 1-11-281 INTERNET INTERNET Cover 118 pages CU Please note correction. We apologize for the inconvenience. The purpose of the CUIC is to assist and educate the general employer community with technical and procedural information pertaining to all facets of employer-employee relations including unemployment insurance labor laws workers compensation and other people-related aspects of the members business.

If you are out of work or have had your hours reduced you may be eligible to receive unemployment benefits. Other important employer taxes not covered here include federal UI. Employers finance the Unemployment Insurance UI program by making tax contributions.

According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. When a person files an unemployment claim the former employer will receive a notice that this person filed the claim. Print or type the information.

DE 1857D English DE 1857DS Spanish. Worked in California and Another State English Spanish. For more information on layoff alternatives preventing fraud and.

Use blue or black ink only. The UI tax funds unemployment compensation programs for eligible employees. Friday April 10 2020.

An incomplete application may delay. Those who are eligible and know how to file an unemployment claim in CA can receive more than financial compensation as the program offers many services to assist participants in obtaining employment. The payroll taxes for unemployment insurance is paid entirely by California employers.

A COVID-19 Update for California Employers. Unemployment Insurance Trust Fund Surcharge As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2020 SUI tax rates will continue to include a 15 surcharge. In California state UI tax is just one of several taxes that employers must pay.

COVID-19 Employer Portal Introducing the COVID-19 Employer Portal a tool designed for California employers to find state and local COVID-19 guidance for their business and more. UNEMPLOYMENT INSURANCE APPLICATION Federal Employee FILING INSTRUCTIONS Complete this application including any applicable attachments. In addition it is important for claimants and employers to understand their roles and responsibilities in making sure that information is reported accurately and benefits are paid appropriately.

The California Employment Development Department EDD is responsible for administrating the Unemployment Insurance UI program in the state. Select one of the following that best describes your employment. Use the paper Unemployment Insurance Application.

If you have been affected by a disaster complete the disaster section of the UI application. Review your application thoroughly for completeness. Visit AB 5 Employment Status to learn how it impacts you.

Mailing of 2020 rate notices and protest deadline. The 2021 DIPFL maximum weekly benefit amount is 1357. File for Unemployment Overview Unemployment Insurance.

2021 CALIFORNIA EMPLOYERS GUIDE DE 44 Rev. Employers often dont realize the real cost of a claim since its spread out over a long period. What should a business expect after an unemployment claim is filed.

Then follow these steps to register and apply for unemployment certify your benefits and manage your claim. Californias Programs for the Unemployed. Notice to Employees-Unemployment Insurance Benefits Advises employees that an employer is registered under the California Unemployment Insurance Code and reports wage credits accumulated and you may be eligible for UI benefits.

Worked in California English Spanish. Unemployment_insurance California Unemployment Insurance Benefits Unemployment benefits are a basic right for employees who have been terminated in the State of California. Each awarded unemployment claim can affect three years of UI tax rates.

Answer all questions on each page. California unemployment insurance UI is available to workers who meet the initial and ongoing requirements set forth by the state. Unemployment Insurance Benefits.

Inside Cover State Disability Insurance SDI. In California no deduction is made from the workers wages to finance unemployment insurance.

Some Who Expected Additional Unemployment Benefits In Ny Did Not Receive It This Week Whec Com

Https Www Kyccla Org Wp Content Uploads 2020 04 Edd E2 80 94 Notice Of 0 Benefit Eng Pdf

Https Www Sagaftra Org Files Sa Documents Filing For Ca Unemployment Pdf

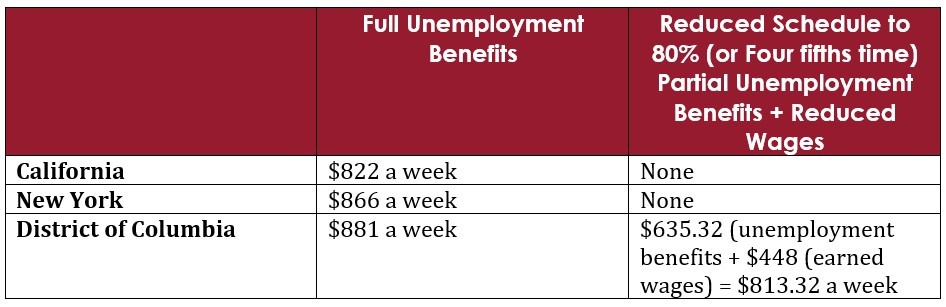

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

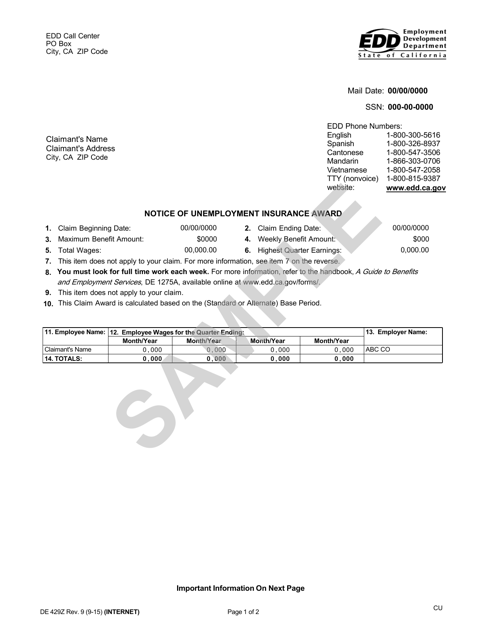

Sample Form De429z Download Printable Pdf Or Fill Online Notice Of Unemployment Insurance Award California Templateroller

Https Www Edd Ca Gov About Edd Pdf News 20 10 Pdf

How To Get California Unemployment Benefits 15 Steps

Sample Form De429z Download Printable Pdf Or Fill Online Notice Of Unemployment Insurance Award California Templateroller

Https Www Kyccla Org Wp Content Uploads 2020 04 Edd E2 80 94 Notice Of 0 Benefit Eng Pdf

California Unemployment Increased 0 9 Since November 2020 California Edd

Https Itvs Website S3 Amazonaws Com Filmmakers Resources A5f18297 10f5 4639 869e 546718b932b9 California 20unemployment 20benefits 20tip 20sheet Pdf

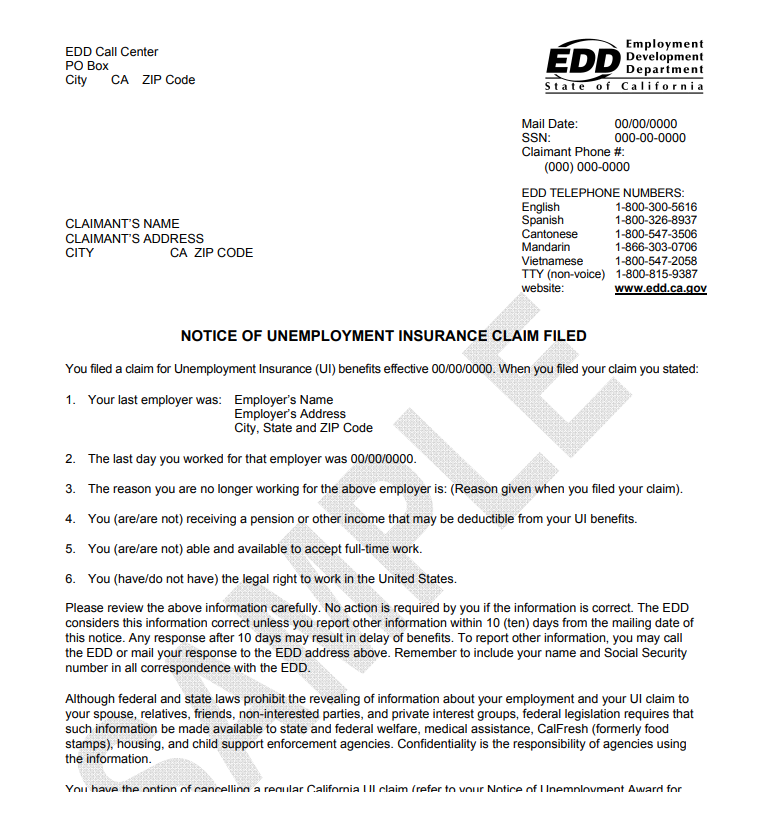

Sample Edd Notice Of Unemployment Insurance Claim Filed Crosner Legal

How To Apply For Unemployment In California Step By Step Full Walkthrough Youtube

All Your Unemployment Insurance Questions Answered Official Website Assemblymember Evan Low Representing The 28th California Assembly District

Https Www Edd Ca Gov Pdf Pub Ctr De1545i Pdf

California Unemployment Increased 0 9 Since November 2020 California Edd

Https Www Goweca Com Portals 0 Edd 20filing 20guide 20 20online 20application 1 Pdf

Https Www Calfac Org Sites Main Files File Attachments Unemployment Rights Supplement Guide 2019 Pdf

Post a Comment for "Unemployment Insurance California Employer"